indiana excise tax form

Remote Seller Verification Form. 1970 DECEMBER 2021.

Trump Paid About 38 Million In Federal Taxes In 2005 Leaked Returns Say The Two Way Npr

Prescribed by the COUNTY AUDITORS CERTIFICATE OF TAX DISTRIBUTION County Form No.

. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. Corrections Indiana Department of. Tips for Your Job Search.

Claim for Refund Process. Heavy Equipment Rental Excise Tax. File and pay Form.

February 23 2022 2020. Form 6478 Biofuel Producer Credit PDF. Claim for Refund Process.

The Resource Form 8849 claim for refund of excise taxes Online Label. Motor driven cycles MDCs are charged a flat rate vehicle excise tax of 1000. INDIANA COUNTY VEHICLE EXCISE TAX AND WHEEL TAX for an example of how the tax is calculated.

Law Enforcement Academy Indiana. To get started click on the appropriate link. I am serving on active military duty in the armed forces of the United States.

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. Remote Seller Verification Form. Indiana Department of Revenue Indiana Brewers Excise Tax Report State Form 46776 Indiana Form AB 910 R 7-02 Reporting Month.

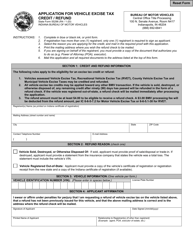

Legal Resources - Click to Expand. APPLICATION FOR VEHICLE EXCISE TAX CREDIT REFUND State Form 55296 R4 1-20 INDIANA BUREAU OF MOTOR VEHICLES BUREAU OF MOTOR VEHICLES Central Office Title Processing 100 N. Under 15 047gallon.

Get Access to the Largest Online Library of Legal Forms for Any State. Form 8849 Claim for Refund of Excise Taxes PDF. Indianas excise tax on gasoline is ranked 19 out of the 50 states.

Heavy Equipment Rental Excise Tax. 140 Sign and date at the bottom of page 2. Visit the Forms and Pubs page.

Find federal tax forms from the Internal Revenue Service online or call 1-800-829-3676. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. View solution in original post.

Taxing Unit I hereby certify that I have this day issued Warrant No. The Indiana state registration fee and the auto sales tax itself is not deductible but all or a portion of the excise taxes you pay may be deductible on Form 1040 Schedule A depending on your circumstances. Form 8821 Tax Information Authorization PDF.

Monthly Excise Tax Return for Alcoholic Beverage Wholesalers. Vehicle Excise Tax Flat Rate 12. Form 6627 Environmental Taxes PDF.

The collection Form 8849 claim for refund of excise taxes Online represents a specific aggregation or gathering of resources found in Indiana State Library. Form 8849 claim for refund of excise taxes Online Resource Information. Publication 3536 Motor Fuel Excise Tax EDI Guide PDF.

On September 16 2014 the BMV announced that it had determined that some Hoosiers vehicles were misclassified for excise tax purposes. But this amount is actually called an excise tax and not a property tax. Know when I will receive my tax refund.

Supporting schedule to be filed with ALC-W. Ad The Leading Online Publisher of Indiana-specific Legal Documents. The gasoline use tax does not affect form MF-360 and licensed gasoline distributors will need to continue to report gasoline.

Form 720 is used to file many types of excise tax including the indoor tanning services excise tax. Gasoline Use Tax - GUT. In addition the tax does not affect collecting remitting or reporting Indiana.

You should consult your tax professional to determine whether this will apply to you. Jobs Marketplace. Model year 1980 or older passenger vehicles trucks with a declared gross weight of not more than 11000 pounds and motorcycles are charged a flat rate vehicle excise tax of 1200.

0 3 6558 Reply. Indiana Liquor Tax - 268 gallon. Senate Avenue Room N417 Indianapolis IN 46204 888 692-6841 INSTRUCTIONS.

Find Indiana tax forms. A portion of Indianas vehicle registration fees are tax deductible. Wayne Indiana December 16 2021 1.

22 State Board of Accounts REV. The IRS only allows that portion of a state registration fee that is based on the value of the vehicle to be included toward your other itemized deductions. Taxpayer Information Name As It Appears on Permit Physical.

Supporting schedule to be filed with ALC-FW. Complete Indiana Brewers Excise Tax Report - FormSend online with US Legal Forms. The Indiana excise tax on gasoline is 1800 per gallon higher then 62 of the other 50 states.

National Guard Indiana. Easily fill out PDF blank edit and sign them. New Member June 4 2019 832 PM.

State Excise Police Indiana. Homeland Security Department of. INtax - Log In or Create new Account INtax will continue to provide the ability to file and pay for the following tax types until July 2022.

To file andor pay business sales and withholding taxes please visit INTIMEdoringov. DECEMBER 2021 EXCISE SETTLEMENT Ft. About 185000 or 36 percent of the 51 million Hoosiers who registered vehicles with the BMV.

Criminal Justice Institute. _____on the Treasurer of Allen County Indiana in favor of _____. Excise Refund Claim Form.

AFFIDAVIT FOR MILITARY EXEMPTION FROM EXCISE TAX State Form 46402 R4 2-13 INDIANA BUREAU OF MOTOR VEHICLES SECTION 1 - APPLICANT AFFIRMATION To receive a military exemption from excise tax all of the following criteria must be met. Indiana Career Connect. Complete your information at the top of the form name address etc Enter the amount of tax paid on page 2 Part II IRS No.

Monthly Excise Tax Return for Indiana-Based Farm Wineries. If the only excise tax you need to report is for indoor tanning services. Form 8864 Biodiesel and Renewable Diesel Fuels Credit PDF.

Complete in blue or black ink or print form. Where do I go for tax forms. Indianas general sales tax of 7 also applies to the purchase of liquor.

Publication 510 Excise Taxes PDF. Find forms online at our Indiana tax forms website order by phone at 317-615-2581 leave your order on voice mail available 24 hours a day. I am currently residing in the.

As a result those customers overpaid excise taxes when registering their vehicles. State Form 55569 R 5-14 ALC-FW Form Indiana Farm Winery Excise Tax Return Reporting Month ______________ Year ________ Indiana Department of Revenue Amended Return No Activity This return must be postmarked on or before the 20th day of the month following the reporting month. In Indiana liquor vendors are responsible for paying a state excise tax of 268 per gallon plus Federal excise taxes for all liquor sold.

Find Indiana tax forms. The Indiana gas tax is included in the pump price at all gas stations in Indiana. My Indiana vehicle registration form shows an excise tax a county wheelsurcharge and a state registration fee.

What Are Marriage Penalties And Bonuses Tax Policy Center

Contract Account Format Accounting Word Doc Words

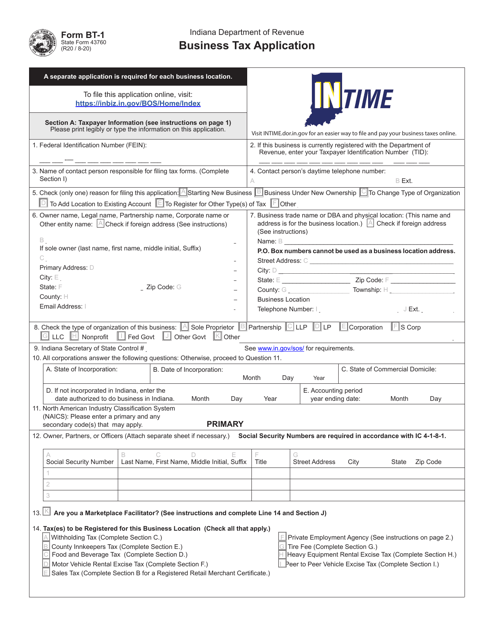

Form Bt 1 State Form 43760 Download Fillable Pdf Or Fill Online Business Tax Application Indiana Templateroller

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Indiana Dor Adds More Features To New Indiana Tax System Wbiw

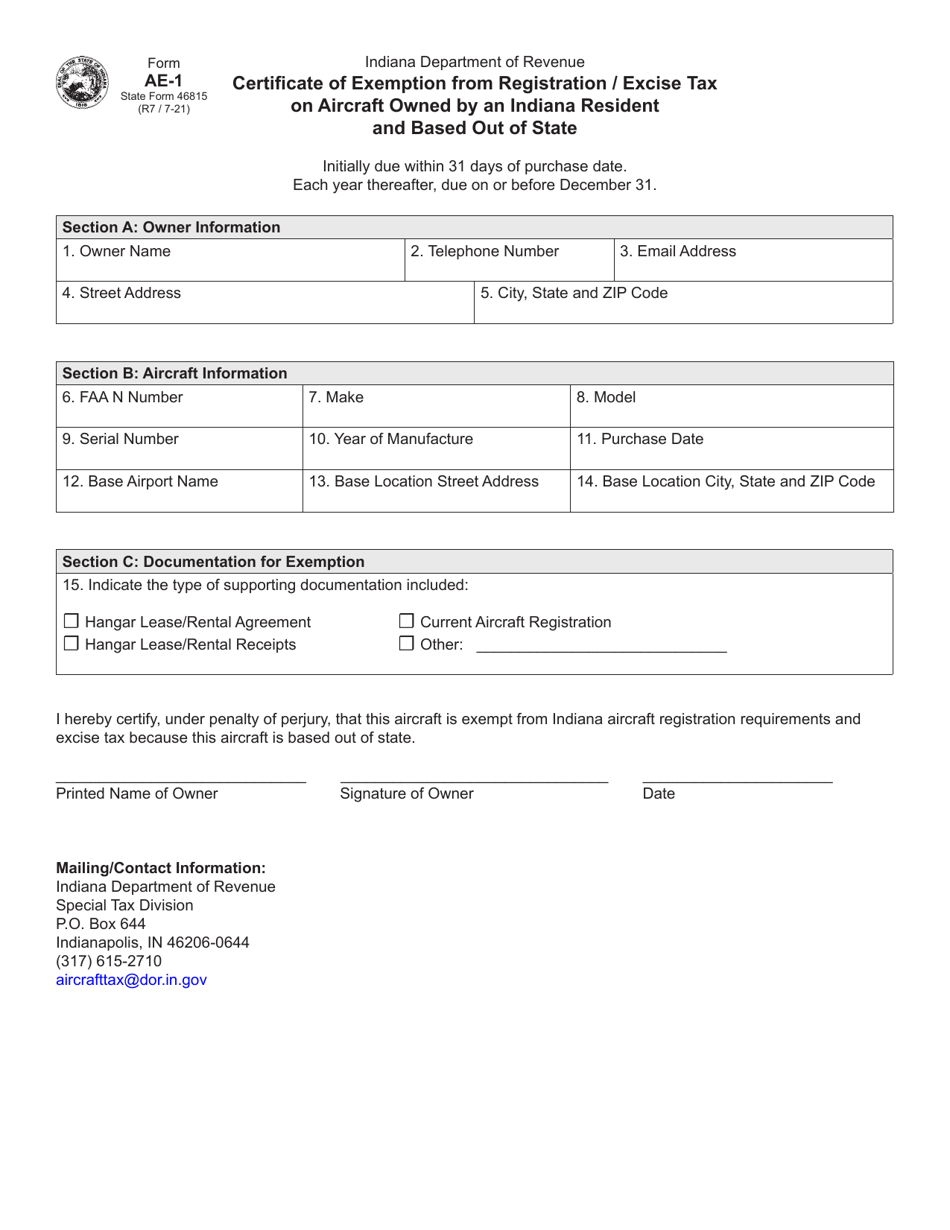

Form Ae 1 State Form 46815 Download Fillable Pdf Or Fill Online Certificate Of Exemption From Registration Excise Tax On Aircraft Owned By An Indiana Resident And Based Out Of State Indiana Templateroller

Deducting Property Taxes H R Block

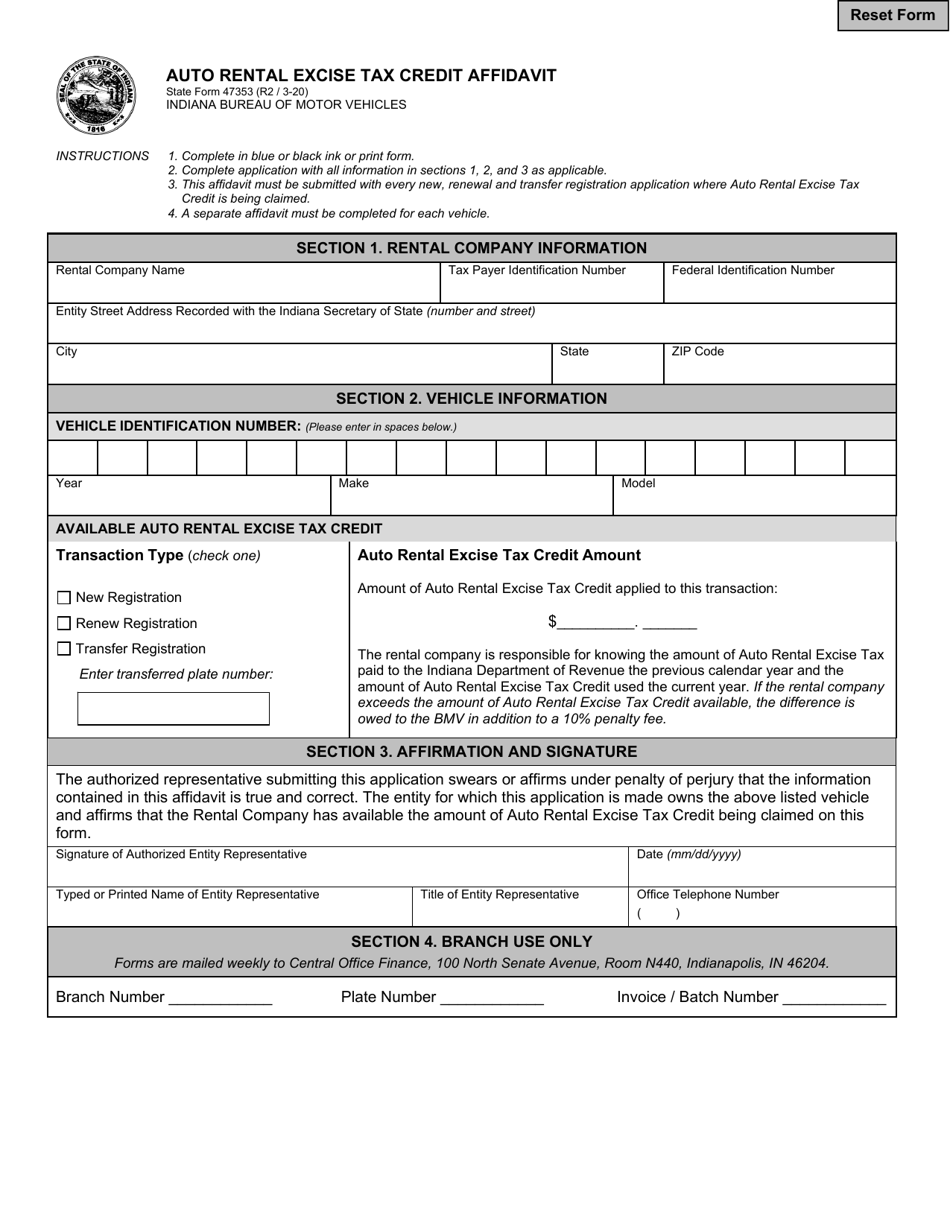

State Form 47353 Download Fillable Pdf Or Fill Online Auto Rental Excise Tax Credit Affidavit Indiana Templateroller

Federal Income Tax Deadline In 2022 Smartasset

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Indiana Tax Application Fill Online Printable Fillable Blank Pdffiller

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller